Income Tax 2025 Calendar Calculator Program – they can utilize the new income tax calculator for FY 2023-24, which is user-friendly and cfan provide results in just a few simple steps. . Most tax preparation companies only allow you to file an IRS Schedule 1 on their free software versions. H&R Block adds IRS Schedule 1 and Schedule 2, allowing you to report more income types and .

Income Tax 2025 Calendar Calculator Program

Source : www.energy.govFederal implications of passthrough entity tax elections

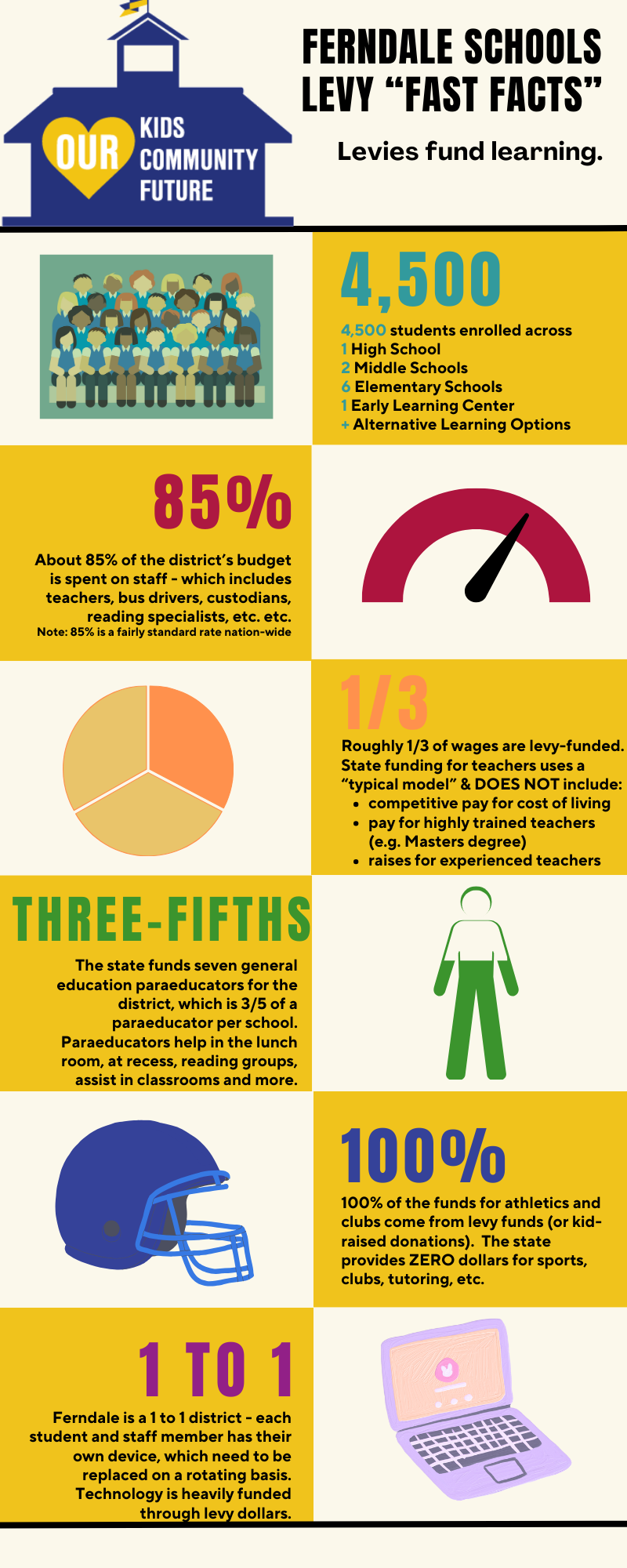

Source : www.thetaxadviser.com2024 Levy Information – Support Ferndale Schools

Source : supportferndaleschools.comBGSU International Programs & Partnerships | Bowling Green OH

Source : www.facebook.comEARNED INCOME TAX CREDIT AWARENESS DAY January 31, 2025

Source : nationaltoday.comFederal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.govTax Brackets in the US: Examples, Pros, and Cons

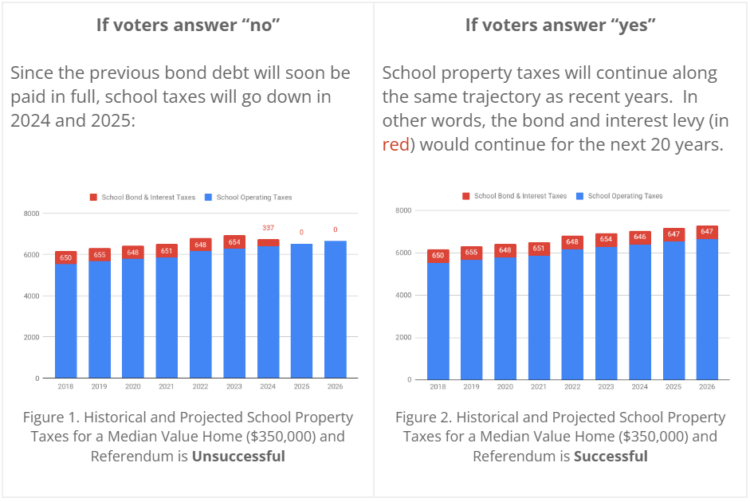

Source : www.investopedia.comNews | Referendum: Making Sense of the Tax Implications | BPS101

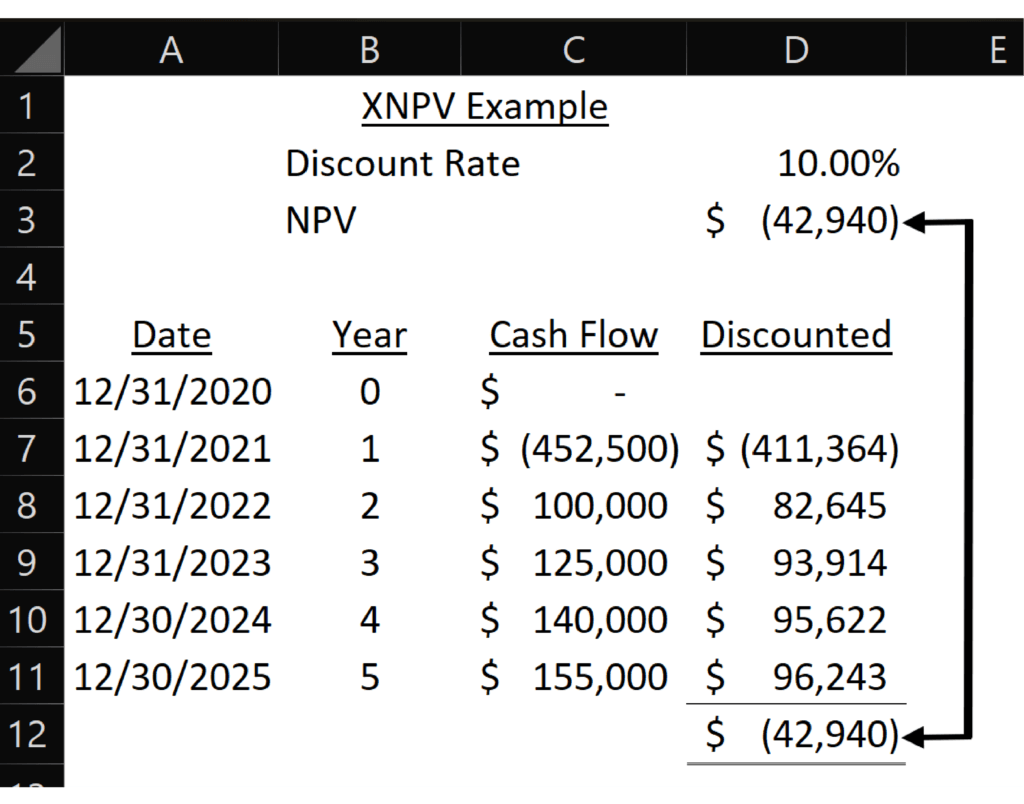

Source : www.bps101.netAssess Return with NPV, IRR, and Time to Break Even in Excel

Source : cfoperspective.comFAFSA Guide | Houston Community College HCC

Source : www.hccs.eduIncome Tax 2025 Calendar Calculator Program Federal Solar Tax Credits for Businesses | Department of Energy: 2024 tax brackets (for taxes filed in 2025 remaining income between $44,726 to 95,375 ($274) — which comes down to $60.28 This adds up to $5,207.16 in taxes for the 2023 calendar year. . The earned income tax credit errors in close to 25% of tax returns claiming it. Online tax filing software can help. The IRS also offers an “EITC Assistant” calculator. .

]]>

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)